London based Strategy and M&A Advisory Boutique for growth stage companies

About

The Company

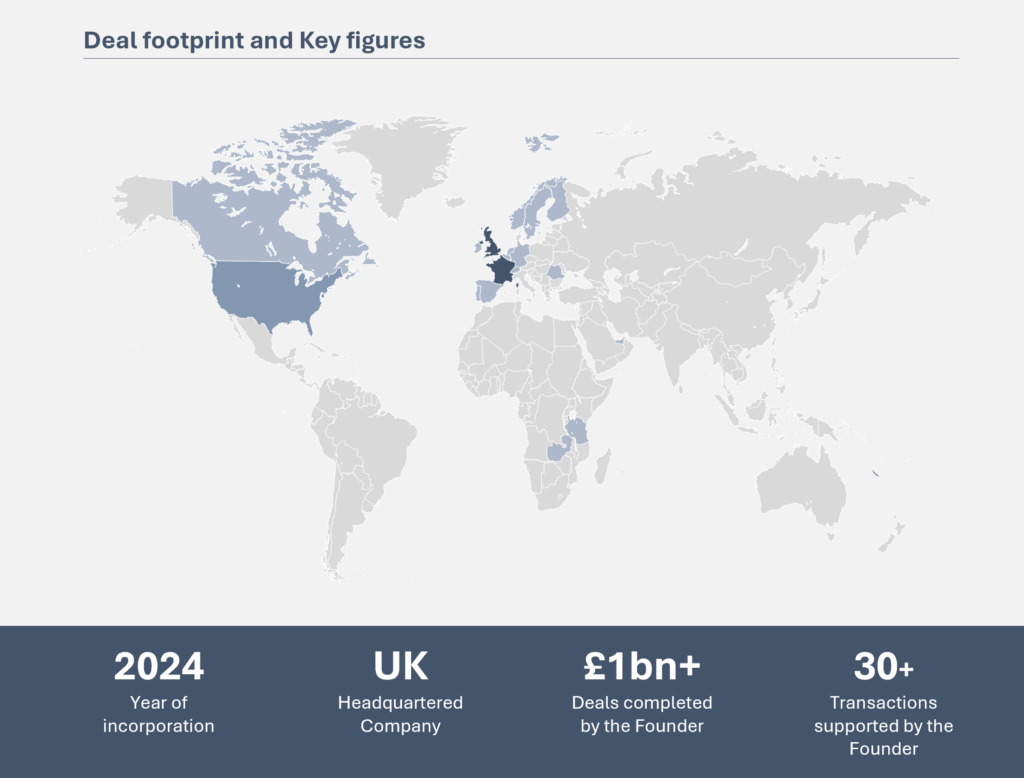

Frontline Capital is a boutique investment advisory firm, established in London in late 2024. Founded by a former head of practice and founding member of BearingPoint Capital UK, the firm operates through a network of affiliated advisors.

Our Services

We offer senior Strategy and Mergers & Acquisitions (M&A) advisory services tailored for growth-stage companies, covering corporate strategy, buy-side mandates, sell-side mandates, carve-outs, and integrations.

Our Mission

Frontline Capital provides founders and directors of growth-stage companies with access to seasoned professionals experienced in advising leading private equity houses and corporations on both private and listed deals across EMEA and North America.

Our Values

We believe that trust is forged through uncompromising excellence. We take pride in delivering bespoke solutions, meticulously tailored to meet the unique requirements of each of our clients.

Industries

Software & Technology

Professional Services

Industrials Products

Health & Pharma

Energy & Utilities

Consumer Goods

Services

Corporate Strategy

If you are looking to evaluate new market opportunities, conduct competitor benchmarking, or validate investment opportunities, we bring extensive experience in leading corporate strategy mandates and preparing investment-grade financial models.

Buy-Side Advisory

If you aim to accelerate top-line growth, expand market share, or acquire strategic assets and IPs, we can support you in originating investment opportunities, approaching targets, coordinating due diligence, conducting valuations, and managing negotiations through to completion.

Sell-Side Advisory

If you need assistance in raising funds or selling your business, we offer comprehensive sell-side services. Our support includes developing the equity story, preparing the data room, crafting the confidential information memorandum, conducting a test valuation, identifying and qualifying potential investor profiles, and managing other advisors and counsels throughout the entire sale process.

Deal Operations: Integrations and Carve-outs

Complex transactions mandate meticulous operational planning. Whether you need support in developing an integration strategy, formulating a separation strategy, or designing a target operating model, we can help. This includes assistance with the structure of a group of companies, mapping intercompany and related party agreements, and creating detailed inventories of processes and systems.

Founder’s credentials

(List non-exhaustive, additional credentials available on request)

Corporate Strategy

Software

European Private Equity

Acquired

SaaS Company

Delivered Commercial Due Diligence

Utilities

Nuclear manufacturing group

Delivered industrial strategy, investment plan and financial model

Pharma

European Pharma Group

Considered acquiring

IP Asset (patent rights)

Delivered Commercial Due Diligence

Industrials

European Building Materials Wholesaler

Delivered pricing strategy and implementation in coordination with sales teams

Transports

Leading European rail group

Delivered corporate strategy, investment plan and financial model.

Buy-Side Advisory

FinTech

Mobile banking group

Acquired

Point of Sale solutions

Delivered Buy-side Advisory Services

Services

Consulting group

Acquired

Boutique consultancy

Delivered Buy-side Advisory Services

Software

Consulting group

Acquired

ERP software business

Delivered Buy-side Advisory Services

Industrials

Building management systems group

Considered acquiring

FM services

Delivered Buy-side Advisory Services

Insurance

Insurance group

Considered acquiring

Insurance consultancy

Delivered Buy-side Advisory Services

Sell-Side Advisory

Hospitality

Global Hospitality Group

Formed a JV with

Global Luxury Group

Delivered Joint Venture Advisory

Insurance

Private Equity

Divested Claims management group to

Private Equity

Delivered Sell-side advisory services

Fintech

Web 3 Group

Fundraise preparation

Delivered Sell-side advisory services

SaaS

Software Scale Up

Exit preparation

Delivered Sell-side advisory services

Fintech

Payment services

Fundraise preparation

Delivered Sell-side advisory services

Deal Operations

Pharma

Global Pharmaceutical

Divested (IPO)

Consumer Products BU

Delivered Carve-out Advisory Services

Utilities

UK Energy Production Group

Acquired

Renewable Energy Group

Delivered Integration Advisory Services

Industrial

European Private Equity

Considered acquiring

FM services carve-out

Delivered Carve-out Advisory Services

Automotives

Global Automotive Group

Considered acquiring

Leasing group carve-out

Delivered Carve-out Advisory Services

Services

European Consulting Group

Acquired

Boutique Consultancy

Delivered Integration and Restructuring

Latest Articles

Meet the Founder

About

Pierre Couturier is a seasoned professional with a wealth of experience in Strategy and Mergers & Acquisitions (M&A). As a former Head of Practice and Founding Member at BearingPoint Capital UK, and an M&A Manager at PwC Deals, Pierre has demonstrated strong leadership and expertise. His career has spanned across the major financial hubs of Paris and London, where he has made significant contributions to major transactions, successfully and consistently driving impactful outcomes for his clients.

Experience

Pierre boasts an extensive track record of successfully executing deals ranging from £10 million to over £1 billion for both private and listed organisations. His experience spans a wide array of sectors and industries across the EMEA region and North America.

His expertise extends to delivering transactions for, and targeting companies listed on major stock exchanges such as Euronext (ENX), London Stock Exchange (LSE), Toronto Stock Exchange (TSX), Nasdaq OMX (OMX), and Frankfurt Stock Exchange (FSE).

Purpose

Pierre Couturier established Frontline Capital as a premier advisory firm designed to cater specifically to the needs of small and mid-cap organizations. Recognizing the importance of direct access to senior expertise and the necessity for commercial flexibility, Pierre created Frontline Capital to bridge the gap for businesses that require lean, tailored, high-value added advisory services.

+33 6 68 07 04 98

Get in touch

Whether you wish to enquire about our services, want to get in touch for future opportunities, seek an independent opinion or would like to apply to join as an affiliate advisor, we would love to hear from you.